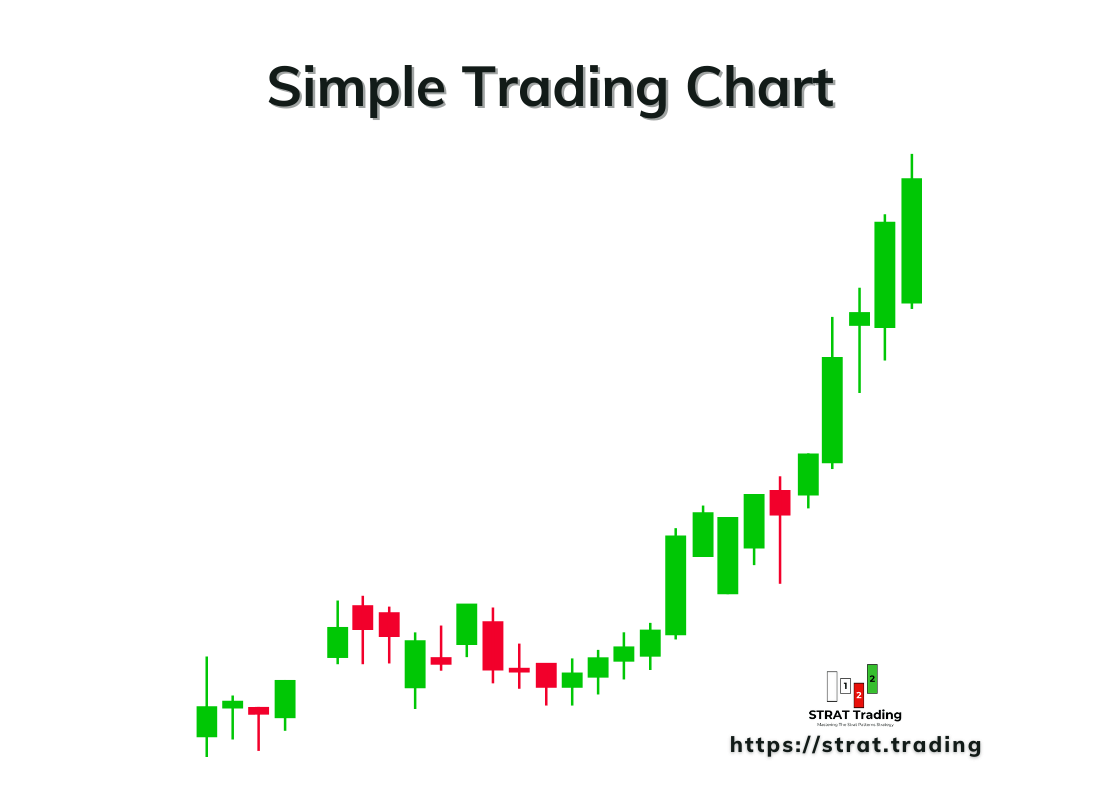

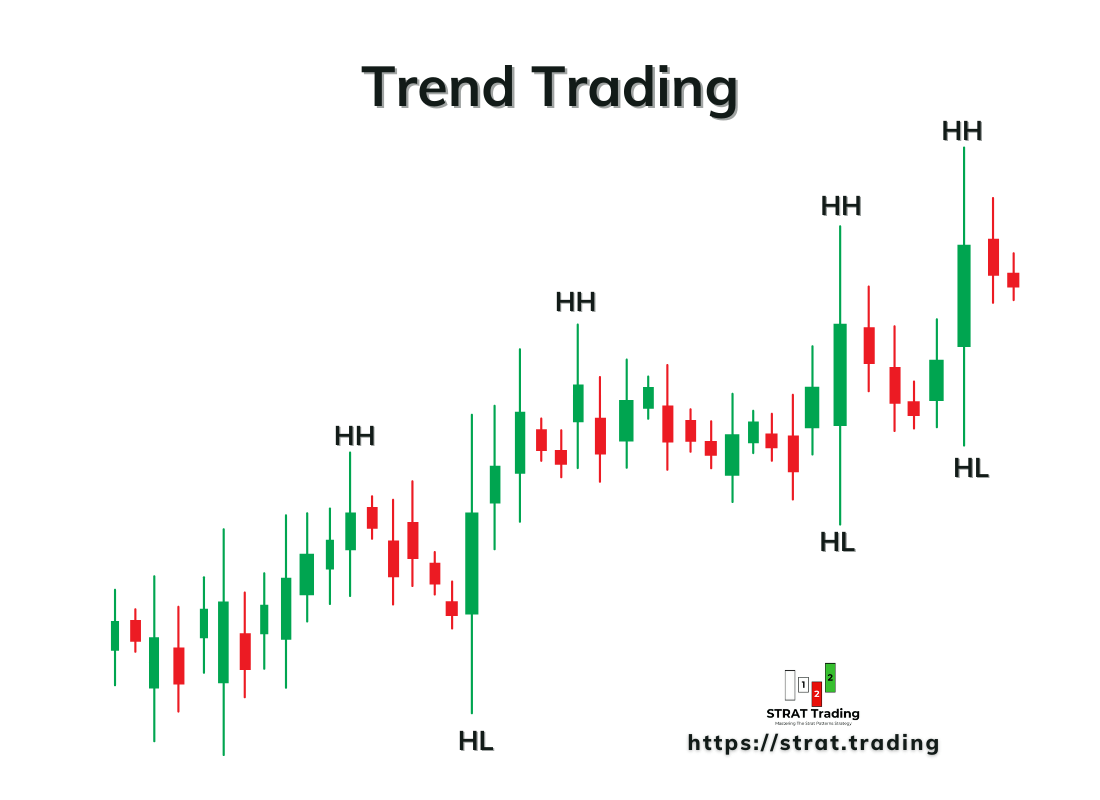

The Strat Patterns is a trend trading method that uses the method of aligning the prices on different timeframes and then trading in that direction.

Most of the traders will know that Trend is Your Friend. It’s reality. It is straightforward to follow trend trading using strat patterns.

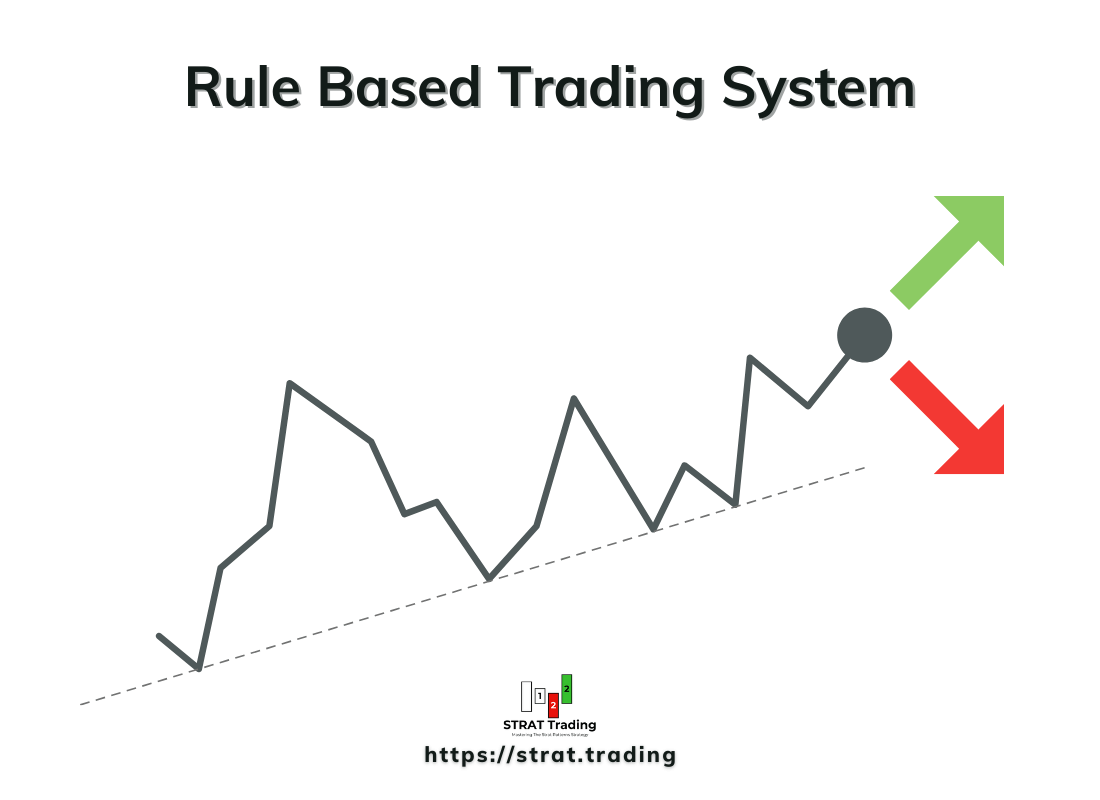

The Strat trading method gives traders a rule-based mechanical trading system that beginners and advanced traders can follow easily. I suggest all traders learn and trade the strat method, a hidden gem.

Origin of The Strat Method

Rob Smith, an experienced stock trading trader, introduced the Strat.

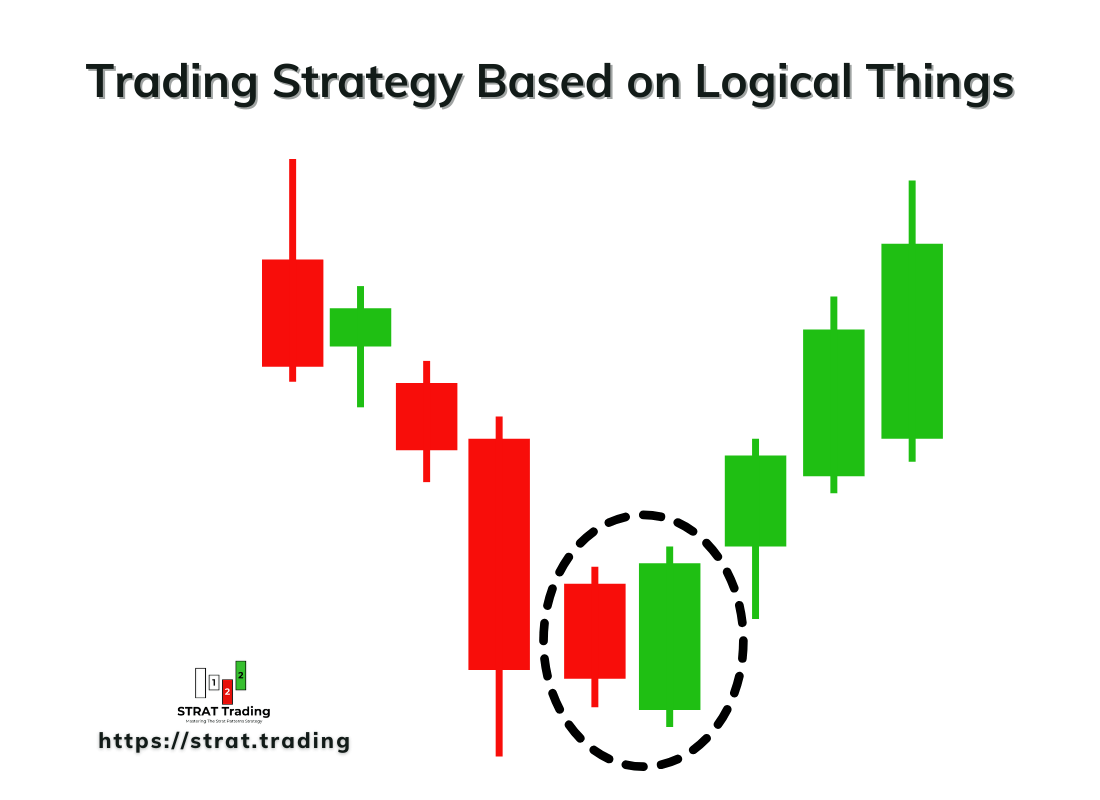

Rob Smith wanted to make things more straightforward and logical. He has prioritized things that are logical and that matter in trading. Then, he made a profitable system by confluences of logical things, which we call the Strat Patterns.

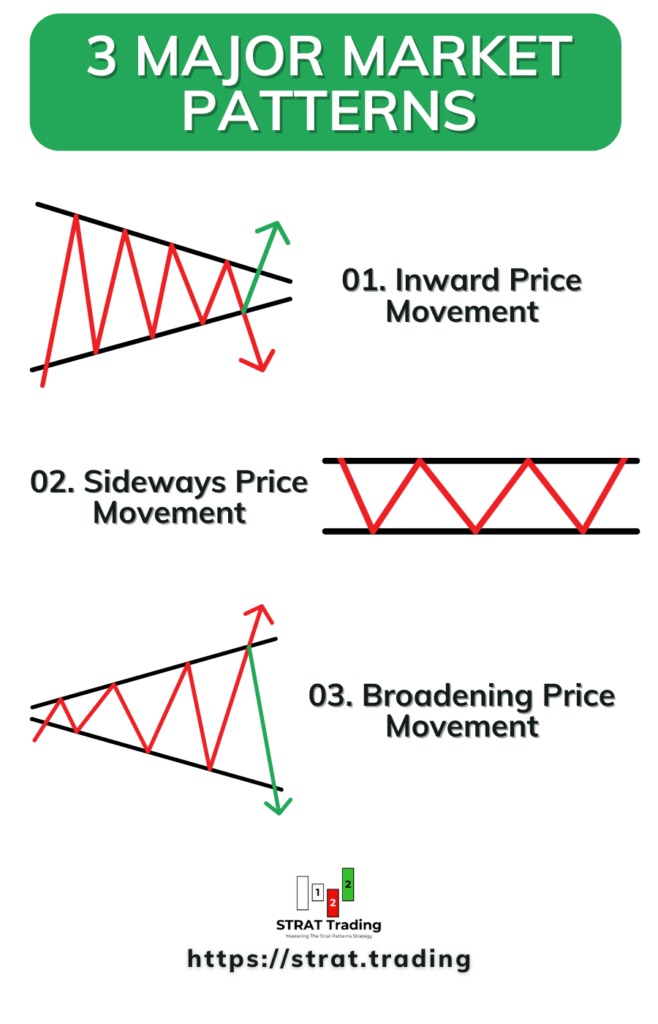

He said that price moves only in three ways.

- Inward

- Outward

- Up / down

According to him, consolidation always breaks when the price consolidates inwards. It can sometimes stay in an inward direction.

Similarly, when the price moves outwards in the form of an outside bar, it cannot stay in this pattern for a long time but move up/down/inward.

These are universal truths that price always breaks the highs or lows of the previous day’s candlestick. So, he used these patterns in trading and made a profitable trading system.

This is just an overview. In this course, I will explain the strat methods in detail, and I am sure you’ll be grateful to me.

Why should I learn the strat trading method?

If you want to be a successful trader, you should not learn a complex trading system. Instead of wasting years on complex trading systems, you need a trading system that has the following characteristics:

- Logical system: The logical trading system is handy. This means it must be based on logical things based on natural patterns and those works in the trading world. For example, the formation of the inside bar and then the break out of the inside bar is confirmed.

- Simplicity: Simplicity is the second most important thing in a trading system. Simple things are easy to digest and apply accurately. Learning a complex trading system and applying it inaccurately could be more helpful.

- Rule-based system: If a system is based on a set of rules, then you can trade effectively. On the other hand, if you still need to set rules, it will create confusion while trading on a real account. That’s why rules are fundamental.

- Trend trading: A trading system must follow the strategy of institutional traders. We should not trade against institutional traders. Because the market makers always win in the trading. So, to stay on the winning side, we should follow market makers, not retail traders. So, trend trading is a vital element of a trading system.

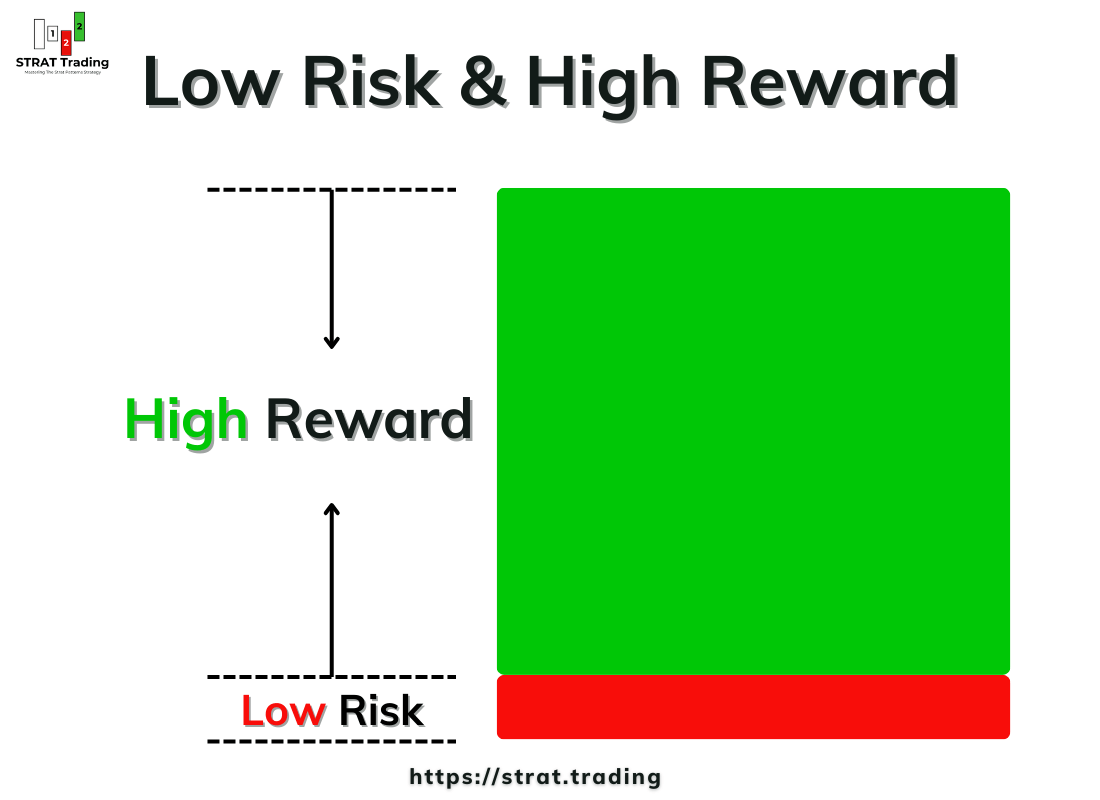

- Low risk and high reward: A trading system should always use a stop loss to protect the capital. This is not a trading strategy if you win for the whole week but lose the whole account the next day. So, taking low risks and getting high rewards are the characteristics of a sound trading system.

All these characteristics are present in The Strat Trading System. That’s why it’s ideal for traders to learn and trade using the strat patterns.

Fundamental principles

The strat trading strategy is based on three fundamental principles that help to trade profitably.

These are as follows:

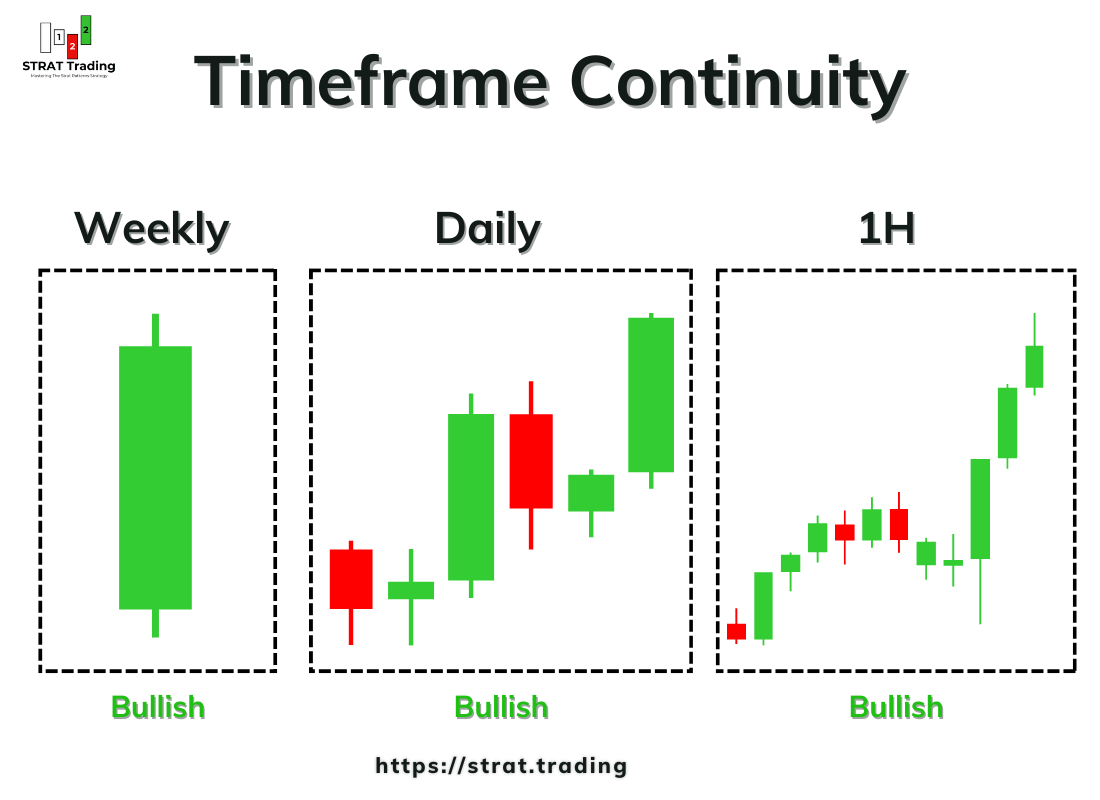

- Timeframe continuity: Rob Smith believes that it is a strong signal when all the timeframes align or show the same direction, either up or down. Instead, if any timeframe shows consolidation inward or outward, it is a discontinuity signal. A trader must trade only when all the timeframes show the same direction.

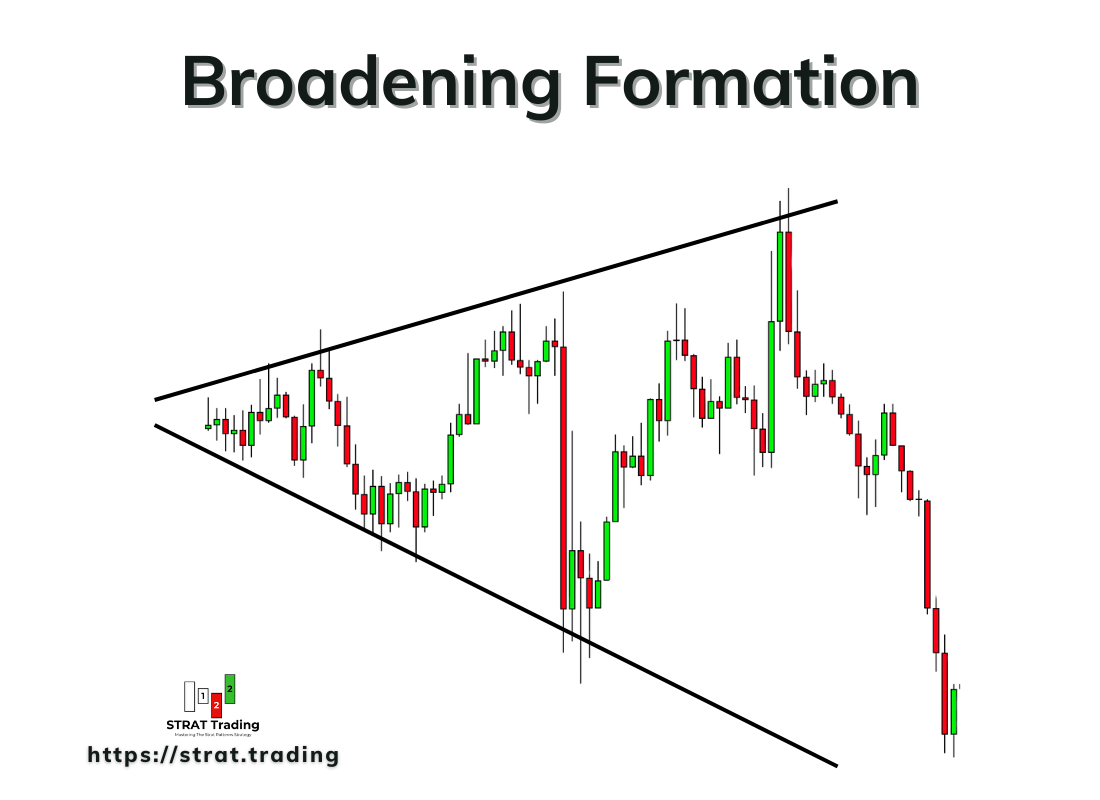

- Broadening formation: This is another central concept that helps to find the magnitude of a trade. It helps to find the trade potential. In simple words, how far will the market go before balance? In a broadening formation, the price will always break the previous range’s highs or lows, which is a universal truth. So, if we believe in this principle and trade on this, the probability of profit will also increase.

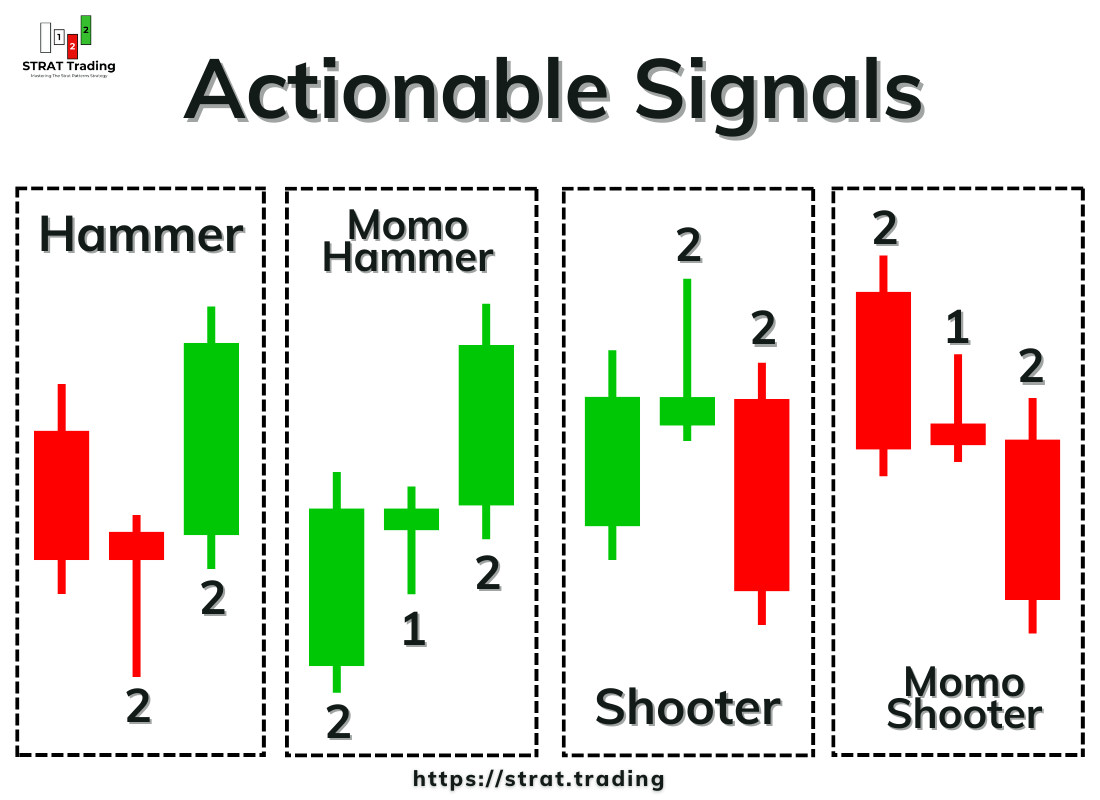

- Actionable signals: After aligning the confluences, the next step is to open a trade and add stop loss. We use actionable signals for entry and exit. Actionable signals are the specific candlestick patterns in a proper sequence showing signs of reversal or continuation. Then, we trade only in the direction of confluences like timeframe continuity.

The strat trading system is not just a trading strategy but a complete trading system based on logical price patterns.

These are just basic concepts, and I will also explain advanced concepts in this course so you can trade like a professional trader. It does not matter whether you’re a beginner or an advanced trader. This course will change the way you look at the price chart.

What type of markets can we trade with The Strat?

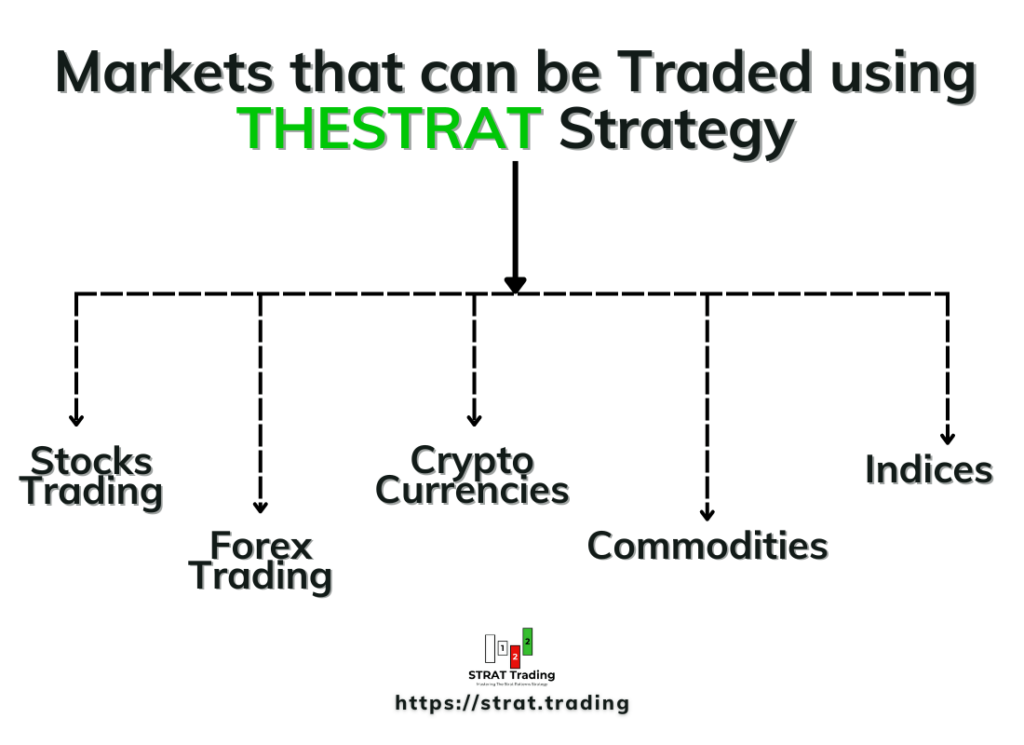

The strat pattern is a price-based trading system that uses the market structure for prediction. It is not limited to specific markets.

Here’s the list of markets that can be traded using the strat trading method:

- Stocks trading

- Forex trading

- Crypto Currencies

- Commodities

- Indices

- ETFs

No matter the market, The strategy is a rule-based system that applies to all the markets. However, you should not apply this technical analysis method to markets with very low liquidity.

Besides the liquidity, it applies to all the trading markets because it’s based on universal price principles, and these principles will continue to work in the trading markets.

You can also diversify your portfolio by using the strat patterns strategy. For example, day trading the forex currencies and position trading the stocks. This will diversify your trading portfolio, and your trading account will remain green long-term.

What to do next?

I hope you will now be able to understand the techniques and strategies that I am going to teach you in the following posts.

Now, you must open the charts and observe the inside bar formations and outside bar or broadening pattern formation. You will need to observe these patterns. I will explain the strat patterns in detail in the following educational lessons.

Trade only what you know to be true

Rob Smith

It means trade only based on knowledge and experience rather than speculation.

Remember that you must become a trader who follows the institutional traders, not the market crowd.

Also, only follow tips or tricks when backtesting on the live chart.

Conclusion

To wrap this up, learning The Strat Trading method will help you reach your trading goals, and after learning, you’ll be able to make passive monthly income. It’s the best part-time or full-time business.

This was just an introduction, and from the following posts, I will make valuable educational posts for you. So stay updated and trade only what you know to be true.

I would love it if you would ask questions from me in the comments below. Your questions can also help beginner traders, maybe with the stuff they are wondering about but have yet to ask.

So ask questions, and let’s become better traders by helping each other.