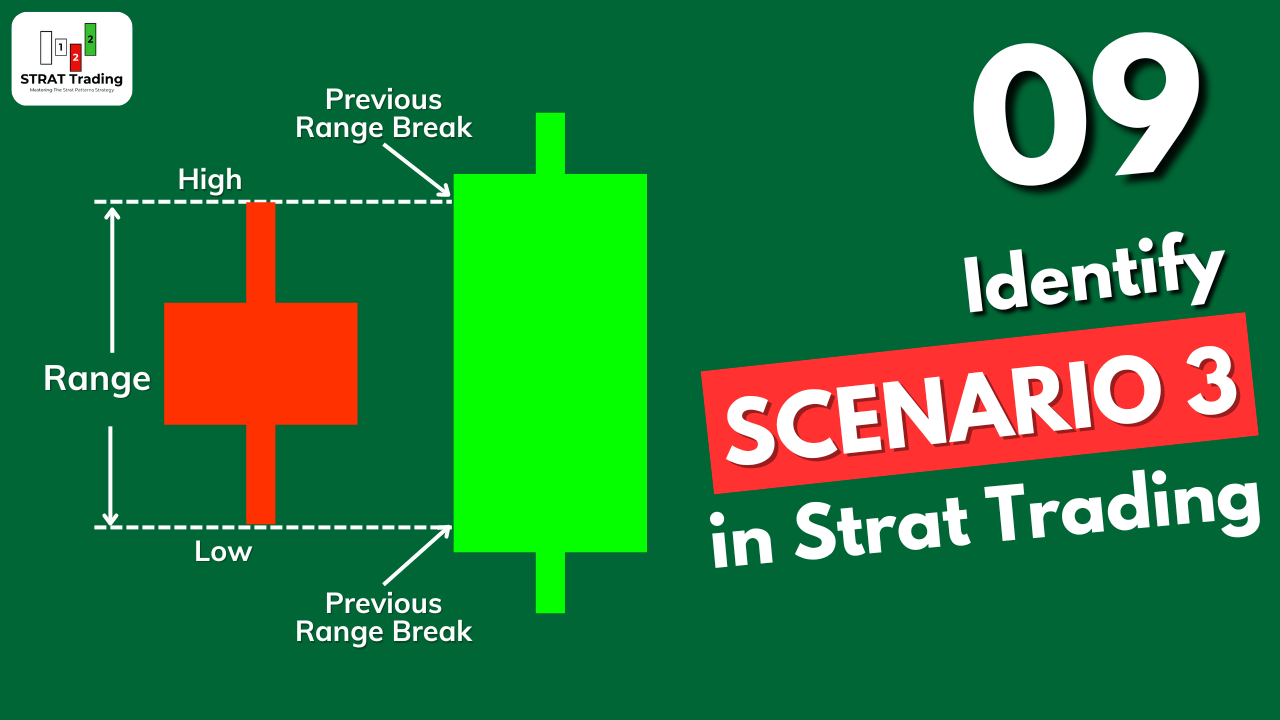

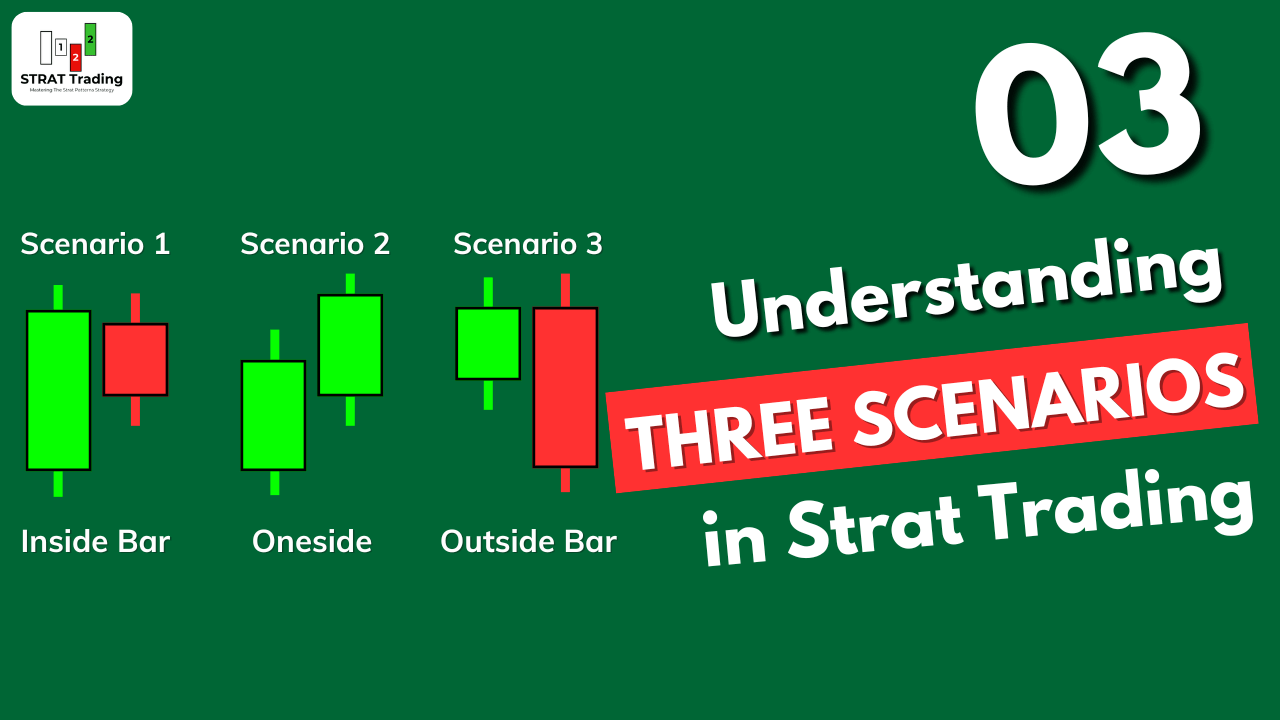

Scenario 3: Outside bar in the Strat Trading

When the current candlestick takes out both sides of the previous candlestick, then it means scenario 3 has been formed on the chart. It is also known as the engulfing pattern or outside bar in trading. In the strat patterns, scenario 3 tells about the expansion of price range and a major trend reversal. The … Read more